Ficus Bank H-24A free printable template

Show details

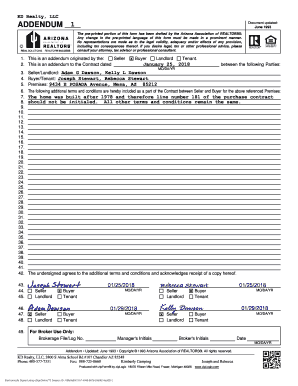

H-24 A Mortgage Loan Transaction Loan Estimate Blank. This form provides two variations of page one four variations of page two and eight variations of page three. Sample variations of page one one page two one page three four variations of page four and two variations of page five. Second-Lien Loan in Summaries of Transactions Seller s Second-Lien Loan Outside of Closing in Summaries of Transactions 19 e 3 violation with Financed Closing Costs for Disclosure Provided to Seller for...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Ficus Bank H-24A

Edit your Ficus Bank H-24A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Ficus Bank H-24A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Ficus Bank H-24A online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Ficus Bank H-24A. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Ficus Bank H-24A

How to fill out Ficus Bank H-24(A)

01

Gather necessary information including your personal details, account numbers, and financial data.

02

Begin filling out the form by entering your name and contact information in the designated fields.

03

Input your account information as required, ensuring accuracy to avoid processing delays.

04

Provide your financial history and any other relevant details in the specified sections.

05

Review the completed form for any errors or omissions.

06

Sign and date the form as required to validate your submission.

07

Submit the form either electronically or in person, following the instructions provided by Ficus Bank.

Who needs Ficus Bank H-24(A)?

01

Individuals seeking to open a new account with Ficus Bank.

02

Current customers needing to provide updated financial information.

03

Businesses applying for loans or financial services from Ficus Bank.

Fill

form

: Try Risk Free

People Also Ask about

How many days after a loan estimate can you close?

Loan Estimate vs. Closing Disclosure DocumentWhen you get itNo. of pagesLoan EstimateWithin 3 business days after applying for a loan3Closing DisclosureAt least 3 business days before closing your loan5 Feb 8, 2023

When must the closing disclosure be received by the applicant?

By law, you must receive your Closing Disclosure at least three business days before your closing. Read your Closing Disclosure carefully. It tells you how much you will pay for your loan.

What triggers a loan estimate?

Common reasons you may receive a revised Loan Estimate include: The home was appraised at less than the sales price. Your lender could not document your overtime, bonus, or other irregular income. You decided to get a different kind of loan or change your down payment amount.

What is form H 24?

H-24(G) Mortgage Loan Transaction Loan Estimate - Modification to Loan Estimate for Transaction Not Involving Seller - Model Form. H-25(A) Mortgage Loan Transaction Closing Disclosure - Model Form.

When should you receive your closing disclosure?

Lenders are required to provide your Closing Disclosure three business days before your scheduled closing. Use these days wisely—now is the time to resolve problems. If something looks different from what you expected, ask why.

At what time must the lender provide the closing disclosure to the buyer?

The lender is required to give you the Closing Disclosure at least three business days before you close on the mortgage loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete Ficus Bank H-24A online?

pdfFiller has made filling out and eSigning Ficus Bank H-24A easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit Ficus Bank H-24A straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing Ficus Bank H-24A.

How do I fill out Ficus Bank H-24A on an Android device?

On Android, use the pdfFiller mobile app to finish your Ficus Bank H-24A. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is Ficus Bank H-24(A)?

Ficus Bank H-24(A) is a financial reporting form used by certain banks to disclose specific information related to their operations and compliance with regulatory requirements.

Who is required to file Ficus Bank H-24(A)?

Banks that meet certain criteria established by regulatory authorities, typically those involved in specific types of lending or investment activities, are required to file Ficus Bank H-24(A).

How to fill out Ficus Bank H-24(A)?

To fill out Ficus Bank H-24(A), banks need to provide accurate financial data, comply with the provided guidelines, and ensure all required sections are completed as per the instructions given by the regulatory authority.

What is the purpose of Ficus Bank H-24(A)?

The purpose of Ficus Bank H-24(A) is to provide regulatory agencies with essential data that assists in monitoring the financial health and compliance of banks, ensuring they adhere to legal and operational standards.

What information must be reported on Ficus Bank H-24(A)?

Ficus Bank H-24(A) must report data such as total assets, liabilities, specific loan categories, interest rates, and other relevant financial metrics that define the bank's performance and risk exposure.

Fill out your Ficus Bank H-24A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ficus Bank H-24a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.